It’s a whole new ball game this year when it comes to how you pay taxes. The Tax Cuts and Jobs Act enacted in December 2017 is going to change tax planning for many, many taxpayers this year. You may be one of them. American Bank & Trust thinks it’s important you know the following tax changes.

Tax changes to expect

You can expect fewer itemizers this year. The rough doubling of the standard deduction is expected to allow up to 90% of taxpayers to give up tracking their deductions. What’s more, many deductions have been eliminated entirely, and the deduction for state and local taxes is capped at $10,000. Unless your total deductions come to more than $12,000 for singles, $24,000 for marrieds filing jointly, the standard deduction will be the way to go.

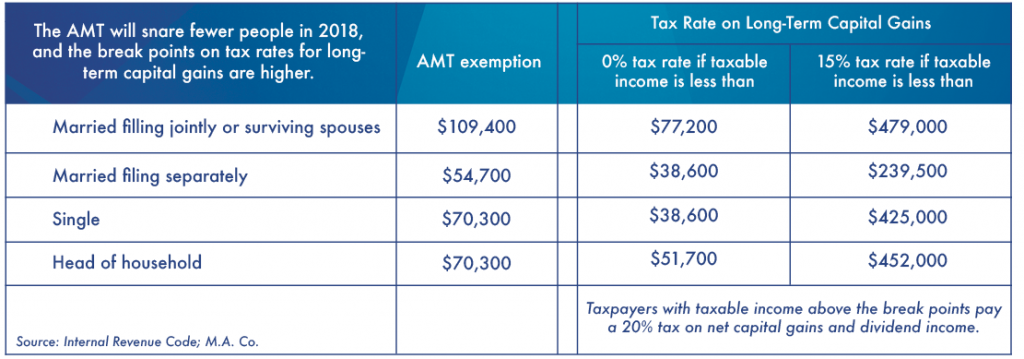

Fewer taxpayers will be caught by the alternative minimum tax (AMT), as the AMT exemption has been significantly increased. See the table below for details to assist in your tax planning. If you’ve been snared in past years by the AMT, you already know what it’s like to lose 100% of your deductions for state and local taxes. If you’re excused from the AMT this year, you may now be able to take advantage of that deduction again.

Portfolio planning will be complicated, given the change in break points for the tax on long-term capital gains and the wild ride in this year’s stock markets. See the table below new tax rates. We will discuss the importance of identifying which lot of stocks you wish to sell, should selling be part of your year-end planning.

New boundaries

Avoiding short-term gains

The tax rate on a capital gain from the sale of an asset held for more than a year is generally about half of that on the sale of something held for a year or less. This can create a quandary. Should an investor lock in a gain while the price is high, or risk a market downturn by waiting until the longer holding period is satisfied? No doubt, in today’s volatile financial markets, this call is often not an easy one to make in your investment and tax planning. Still, a bias toward longer-term holding periods will lead to better overall tax results.

Using tax-deferred accounts wisely

There is a temptation to hold appreciating assets, such as stocks, in a tax-deferred account, such as a traditional IRA. Years of tax-free compounding are certainly attractive. On the other hand, all distributions from the traditional IRA will be taxed as ordinary income. There is no preferential tax rate for long-term holdings. What’s more, the basis step-up at death doesn’t apply to assets in retirement accounts. Accordingly, the better result for some investors will come from owning their appreciating assets in a taxable account. Investors will also see better results from investing their IRAs in bonds and other income-oriented choices.

The zero tax on some capital gains

Taxpayers in the lowest tax bracket pay no tax at all on their capital gains. Should the taxpayer experience a year of falling into that low bracket, it’s a great time to harvest gains at no tax cost. The more likely scenario for an affluent family is in the realm of gifts.

For example, a grandparent who would like to give $15,000 to a grandchild, perhaps to help with higher-education expenses, would be well advised to instead give the grandchild appreciated securities. Assuming that the grandchild has only nominal income, the stocks may be sold without any tax drag on the proceeds.

Converting to a Roth IRA

Conversion of a traditional IRA to a Roth IRA is a taxable event, and the tax can be substantial. However, with the Roth IRA all future income and capital appreciation have the potential of being fully tax free. Should a taxpayer find himself or herself in a lower bracket than usual, it well may be a good time to consider such a conversion.

Changes in the law always affect your tax planning and your financial strategy. See your American Bank & Trust expert before making any final decision.