by Erin VerMulm | Nov 14, 2024 | Latest News

We have officially broken ground on our new Westside Sioux Falls branch! Located at the corner of 26th Street & Tea Ellis Road, the 4,000 square foot facility will be our fourth location in Sioux Falls. “Our ownership group is investing in our communities, the way...

by Erin VerMulm | Sep 26, 2024 | Latest News

We have officially broken ground on our new branch in Tea! Located at the corner of Gateway Lane and Heritage Parkway, this branch will replace our current AB&T branch in Tea located at 100 East 1st Street. The new location will be nearly 4,000 square feet and...

by Erin VerMulm | Aug 21, 2024 | Latest News

At American Bank & Trust, we’re excited to announce the release of our newly designed Spirit Cards. These cards are more than just a way to make purchases—they’re a symbol of community pride and a powerful tool for supporting local schools. Spirit Cards are...

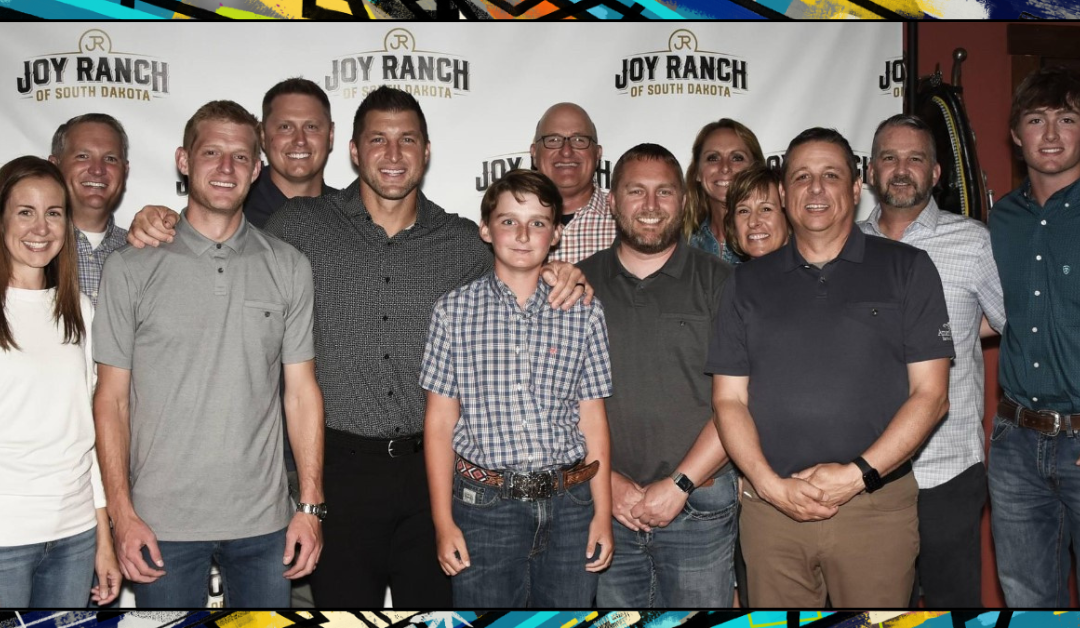

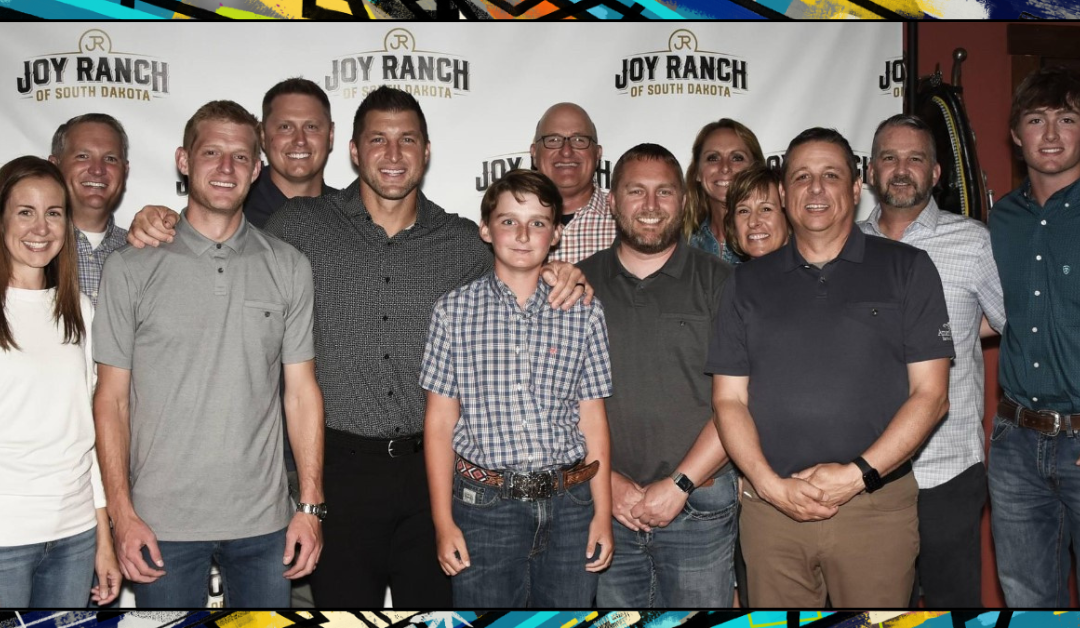

by Erin VerMulm | Jul 17, 2024 | Latest News

Tim Tebow was an amazing inspiration to all who met him or heard his message at Joy Ranch and the Watertown Civic Arena on Friday, June 21, 2024. American Bank & Trust was honored to be the MVP Sponsor for the event and had staff on hand to help at the event. His...

by Erin VerMulm | Jul 16, 2024 | Latest News

American Bank & Trust (AB&T) has been named one of the country’s top agricultural lenders in 2024 by the Independent Community Bankers of America® (ICBA). AB&T ranks sixth on the list of community banks with over $1 billion assets. “Our roots are...

by Erin VerMulm | May 28, 2024 | Latest News

American Bank & Trust (AB&T) is pleased to announce that Kathy Graff has joined the bank as market president in Tea and Bill Kuhl as market president in Lennox. Kuhl and Graff bring a combined 55 years of financial services experience to serve and grow these...